GROWTH IN HOMEOWNERS' EQUITY CONTINUES

By Michael Neal

According to the Federal Reserve Board's third quarter of 2016 release of its Financial Accounts of the United States report, household holdings of real estate, measured on a not seasonally adjusted basis, totaled $22.725 trillion in the third quarter of 2016, $1.520 trillion higher than its level in the third quarter of 2015, $21.204 trillion.

At the same time, home mortgage debt outstanding, $9.708 trillion in the third quarter of 2016, rose by $185 billion over the same four-quarter period. Since the total value of household-held real estate rose faster than the aggregate amount of mortgage debt outstanding, then home equity held by households grew.

Over the year, total home equity held by households grew by $1.336 trillion, 11.4 percent, to $13.018 trillion. Household's home equity is now 57.3 percent of household real estate.

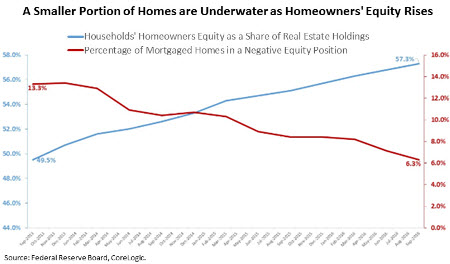

Nationwide, homeowners' equity has been on rising as home prices have reached a new peak. In a separate release, CoreLogic reports that the percentage of underwater mortgaged homes has declined. The rise in homeowners' equity coincides with a drop in the proportion of mortgaged homes that are underwater. A home is considered underwater when the unpaid loan balance(s) exceed the value of the home.

As the figure above illustrates, over the past 13 quarters, the share of mortgaged homes in a negative equity position has dropped by nearly half, from 13.3 percent in the third quarter of 2013 to 6.3 percent in the third quarter of 2016. Over the same period, homeowners' equity, measured as a share of the total value of real estate held by households, has risen from 49.5 percent to 57.3 percent.

Original Source: National Association of Home Builders |

|